#Mortgage Solicitors

Explore tagged Tumblr posts

Text

HOUSE. FUCKIN HOUSE!!!!!!!!!!!!!!!!

#mortgage in principle should be set up by tomorrow.#a lot of annoying fees to pay but whatever makes my life easier bc i cannot wrap my head around half this stuff#i get a £500 cashback with this one :3 its going straight to my solicitor so i have less to pay HFDSJKHFSD#gilly speaks#i should be able to move in at the end of july but i can push for earlier once all the money and legal stuff is handled#im very thankful to be in such a fortunate position with family and friends.........#aurgh. this insane. really looking forward to all the space#i do wish i had the experience of moving out and handling savings sooner but im rly rly thankful i could stay with them for this long and#enjoy life a bit more and save up for a place of my own#plans have been messy and back and forth for moving but im glad i decided to make the jump with my sister after other plans fell thru#and im not mad at plans flopping bc it got me house hunting this year and now here i am#waaah

11 notes

·

View notes

Text

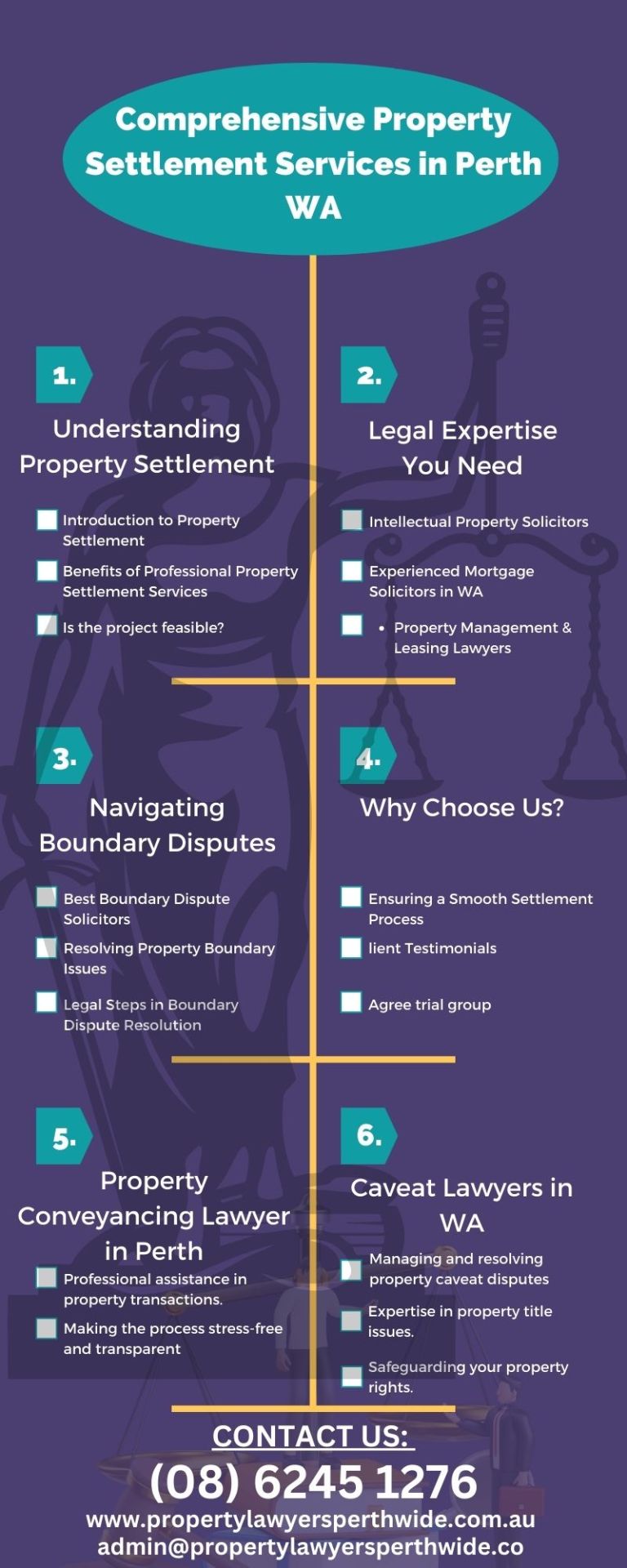

Explore Comprehensive Property Settlement Services in Perth, WA. Our legal experts cover various property aspects, from safeguarding intellectual property rights and managing mortgages to resolving property caveat disputes and overseeing property leasing and management. We specialize in conveyancing and excel in boundary dispute resolutions. Trust our team to ensure your rights and interests are protected. Whether you're a property owner, investor, tenant, or dealing with boundary issues, our services provide a hassle-free, transparent experience. Choose us for all your property needs in Perth, WA.

#intellectual property solicitors#mortgage solicitors in WA#caveat lawyers in WA#property management & leasing lawyers#property conveyancing lawyer in Perth#best boundary dispute solicitors

0 notes

Text

Remortgage Brokers in Leeds

There are a number of remortgage brokers in Leeds who can help you find the best deal for your needs. When choosing a remortgage broker, it's important to find one who is experienced and knowledgeable about the local market. They should be able to help you compare rates from different lenders and find the best deal for your circumstances.

About Remortgaging

A remortgage is when you switch your existing mortgage to a new one. This can be a good option if you're looking to lower your monthly payments, get a better interest rate, or shorten the term of your mortgage.

Tips for Leeds Remortgaging

Some of the tips for remortgaging in Leeds include:

Get your finances in order before you start the process. This includes having a good credit score and being able to afford the higher monthly payments.

Get pre-approved for a mortgage before you start shopping around. This will give you an idea of how much you can borrow and what your monthly payments will be.

Be prepared to negotiate. Don't be afraid to ask for a better deal from the lender.

Benefits of Using Remortgage Brokers

Here are some of the benefits of using a remortgage broker:

They can save you time and hassle by comparing rates from different lenders for you.

They have access to exclusive deals that you may not be able to find on your own.

They can help you understand the remortgage process and make sure you're getting the best deal possible.

If you're thinking of remortgaging your home in Leeds, we recommend using a remortgage broker. They can help you find the best deal for your needs and make the process as smooth as possible.

Conclusion

Overall, don't rush into anything. Take your time and compare rates from different lenders before you make a decision. By so doing, you’ll ensure that you maximise the benefits of using remortgage brokers in Leeds.

0 notes

Text

youtube

This video is about the Australian property market. The subject of this video is: "Step #3, Legals and Solicitor Selection" It is Video #5 in the COOPER and COOPER Investment Property Solutions 50+ series of information videos for 2021. This video is presented by Graham K Cooper R.E.A This information is general in nature and is directed to ALL potential/future property investors in Australia. We attempt to be informative regarding the fluctuating and evolving nature of Interest rates and the Cost of money from day to day, month to month etc. These are facts that you Need to Know as a future property investor. We, as experienced property investors with over 50 years of personal property investing experience, here we help to bring some solutions/answers to your many questions and challenges related to property purchasing. We would be most grateful to you if you could help us to rank high in the Google Analytics by "liking" the video. Also note, that by tapping on the "notifications" button, you will ensure that you do not miss any of our video series. You may contact us via our website at www.cooperandcooper.com.au *** Please Note: Our website is currently undergoing re-construction and re-hosting, if you therefore have any issues, you may also contact us via our alternate emails: [email protected] or [email protected] Simply Click Here to watch this video; • A5 C&C Step #3 Legals and Solicitor S... Thank you for watching today **** ALL OUR PREVIOUSLY NOTED DISCLAIMERS APPLY.

#Real estate#Legals#Buying an Investment property#Choosing Solicitors#Property solicitors#Real Estate Investing#real estate agent#mortgage#HOuses#Houses#Units#Butying property in Australia#Youtube

1 note

·

View note

Text

goodnight i’m exhausted!! a man tried to teach me about mortgages and my husband had to go into another room to laugh because i was nodding along to the guy when he was saying “blah blah yeah so you’ll need a solicitor blah blah” and while i was saying “oh yeah totally yeah a solicitor” i was also googling “what is a solicitor” and spelt it wrong so. yeah. brain fried

#we can afford more house than i thought though so that’s nice#very grown up very serious don’t enjoy but I’m going to paint it so many colours and have nice door handles#plastic ones so they don’t rust and make my hands smell like pennies#finnie shouts into the void

18 notes

·

View notes

Text

OK, so. Renewed provisional driving licence arrived yesterday which means that I can send my old one off to DVLA when I go and buy stamps this morning. I have a catch up with my line manager tomorrow which means that I can ask her for some flexi leave to go to the solicitors and confirm my identity with them. Also hopefully tomorrow I’ll be able to update my bank details on my investment accounts (21 days is a LONG time to wait) and then I can accept my mortgage offer and things can start moving again!

8 notes

·

View notes

Text

Varney the Vampire: Chapter 6

Chapter 5: Please, be responsible with your vampires.

Chapter 6: Originally posted on Livejournal on December 14, 2010. The original one was a bit short, so this has been expanded.

Previously on:

"Be of better cheer, Henry -- be of better cheer," said Marchdale; "there is one circumstance which we ought to consider, it is that, from all we have seen, there seems to be some things which would favour an opinion, Henry, that your ancestor, whose portrait hangs in the chamber which was occupied by Flora, is a vampyre."

Also:

Henry related to George what had taken place outside the house, and the two brothers held a long and interesting conversation for some hours upon that subject, as well as upon others of great importance to their welfare. It was not until the sun's early rays came glaring in at the casement that they both rose, and thought of awakening Flora, who had now slept soundly for so many hours.

I am stunned that this fascinating conversation was not given three chapters of its own. The printer must have put his foot down and said, "I can pay you by the line, not the ton."

CHAPTER VI.

A GLANCE AT THE BANNERWORTH FAMILY. -- THE PROBABLE CONSEQUENCES OF THE MYSTERIOUS APPARITION'S APPEARANCE.

Rymer trusts that it would not be unideal to acquaint us further with the Beaumont Bannerworth family. Short version: previous heads of the Bannerworth family were a bunch of hell-raisin' runnagate gamblers, and thus noble Henry and his family are now quietly penniless. We are told that his father, Marmaduke Bannerworth, Oh Why Not the Second, was "found lying dead" (of what: not specified. sus? absolutely) in the garden, with only an unfinished message written in pencil:

"The money is -- -- " And then there was a long scrawl of the pencil, which seemed to have been occasioned by his sudden decease.

Of course there was. To ramp up the foreshadowing that James Malcolm Rymer might never, ever follow up on, we're also told,

He had, but a few hours before he was found lying dead, made the following singular speech to Henry, -- "Do not regret, Henry, that the old house which has been in our family so long is about to be parted with. Be assured that, if it is but for the first time in my life, I have good and substantial reasons now for what I am about to do. We shall be able to go to some other country, and there live like princes of the land." Where the means were to come from to live like a prince, unless Mr. Bannerworth had some of the German princes in his eye, no one knew but himself, and his sudden death buried with him that most important secret.

Henry, of course, never gets to find out wtf this means. Not entirely sure what the drive-by snark at German princes is about, either. (At this point, the German Confederation was still a few short years away from the Revolutions of 1848. A Regent's Council was ruling Austria for Ferdinand I, who served as a de facto president of the Confederation; the whole thing was decentralized, "weak and ineffective," and so I'm guessing individual princes had a good bit of money and power? I have no idea what this has to do with Marmaduke II's plans.)

So the current Bannerworths, they are broke. And then, suddenly, Random J. Solicitor, Esq., from London writes them to say, "Look, I have this client. I can't tell you who it is, but he'll pay you a shitload of money for the Hall." The Bannerworths want to hold onto the ancestral hall, mortgages and debts and all. "No, seriously. Anything you want." Even the Bannerworths' own lawyer is like, SERIOUSLY, WHY WON'T YOU TAKE THE MONEY? Well, because it's their ancestral family home, and also… there's this guy who likes Flora, and they want to make sure he can drop in on them someday. Because, if they move, they have no way of letting him know.

Now, in 2010, I wrote rather dryly, "I don't know how we survived before Facebook, you guys." The subtext here was, I already hated Facebook and used it, like, twice in my whole life, mostly as a mobile game login. Obviously, this statement hits different in 2023; I'm not sure we'll survive anyway, but this is the gag I wrote 12-13 years ago, and I stand by it:

Flora Bannerworth thinks that Italy is beautiful this time of year

Flora Bannerworth is GOING OVER A CLIFF O NOES!!2!

Charles Holland is saving some random girl he's never met before from certain death-----

Henry Bannerworth likes this-----

George Bannerworth likes this-----

Mrs. Bannerworth likes this

Henry Bannerworth has invited Charles Holland to join The Quietly Penniless Bannerworth Family

And thus, 620 words later, we are introduced to Charles Holland, Artist by Profession, Traveling for Instruction and Amusement, Loved by Everyone (But Especially Flora). Literally, he saved her from a terrific stormy abyss, into which she nearly damseled into off a cliff, and surely would have perished thereunto. Charles Holland then had Somewhere Else to Be for two years—but when he gets done with Something, at Someplace with No Address, he will absolutely come back and look Flora up at Bannerworth Hall! So we definitely cannot move, y'all.

With one exception this was the state of affairs at the hall, and that exception relates to Mr. Marchdale.

Ah: Mrs. Bannerworth's childhood sweetheart, failed suitor, and "distant relative"—shoulda been her cousin, Marchdale, you would've had a far better chance. While we're here, I should tell you my theory about why so many heroines in nineteenth century literature end up marrying their cousins. (An unparalleled example: Louisa May Alcott's Eight Cousins and its sequel Rose in Bloom, in which the Campbell family waits breathlessly to see which of a HERD of male cousins young heiress Rose will marry. She chooses the nerd.) I think it's because cousins were allowed to interact like siblings—that is, like friends—whereas mere acquaintances were held apart from young women by a certain degree of convention and propriety. Courtship was often ridiculously formal, particularly as the century wore on. So, for a writer, it would be really appealing to have a male character in place that your heroine can even just be around, someone the reader can witness her having an emotional relationship with—not just a superficial introduction, then a perfunctory proposal. So it's far more narratively satisfying to go with "the cousin we've known for the entire book" instead of "cousin's random friend we saw three times." Even Charles Holland rapidly gets promoted to—well, we'll get to that.

Instead, Mrs. Bannerworth "had, as is generally the case among several admirers, chosen the very worst: that is, the man who had treated her with the most indifference and who paid her the least attention." Not to mention, a dissipated gambler. Good to see that, even back in the day, the Bad Boy Fallacy was already in effect.

So, after the Very Worst turned up dead in the garden, Marchdale renewed his attentions to his old flame and distant relative, the Widow Bannerworth:

It might have been some slight tenderness towards him which had never left her, or it might be the pleasure merely of seeing one whom she had known intimately in early life, but, be that as it may, she certainly gave him a kindly welcome; and he, after consenting to remain for some time as a visitor at the hall, won the esteem of the whole family by his frank demeanour and cultivated intellect.

Marchdale (we are told) is well-traveled, courteous, spins a good yarn on a dull 1840s night, and has "a small [financial] independence of his own," so he's actually better off than the family hosting him, and finds ways to support them. This is the Bannerworth household, all told, and they're making it work. Sometimes a family is a widow, her three adult children, her cousin-suitor, and his crowbar.

Such then may be considered by our readers as a brief outline of the state of affairs among the Bannerworths -- a state which was pregnant with changes, and which changes were now likely to be rapid and conclusive. How far the feelings of the family towards the ancient house of their race would be altered by the appearance at it of so fearful a visitor as a vampyre, we will not stop to inquire, inasmuch as such feelings will develop themselves as we proceed.

Well—wait. What? "Altered by the appearance at it of"? What the hell is this? God, it's like the literary equivalent of a speed bump. Anyway: all the servants promptly quit. Sorry—the feelings of the domestics inasmuch as the domestics could afford to have feelings were inevitably altered towards the desirability of the wages paid thereunto by the appearance of a fucking vampire. Ugh. Nobody wants to work these days.

(Chapter 7 will go up Friday, March 31.)

77 notes

·

View notes

Note

hi bitches!! just wanted to share the absolute insanity of my last 12 days!

day 0: found out we are being evicted because the landlord wants our house back. we have done nothing wrong and broken no rules but turns out he can still do that! we have 2 months to get out.

day 0.5: decide we are going to try and buy a house. luckily our savings can scrape into a small deposit already!

day 3: mortgage agreement in principle achieved on the second phone call. first house viewing

day 5: fourth house viewing. offer made!

day 6: find out we are one of six offers and some are much higher. can't up our budget to match. continue to view houses. select and instruct solicitor in preparation (using local recommendations)

day 8: saturday afternoon. a new house comes on the market. it is GORGEOUS. viewing request sent within 3 minutes.

day 9-10: easter bank holiday weekend. try not to lose mind while waiting.

day 11: offer on fourth house officially rejected. viewing on Gorgeous House. immediate discussion of how far we can push the budget to secure it FAST. offer made + essay written to seller on why we are the perfect buyers and they should immediately take the house off the market and cancel all their other viewings.

day 11.5: cannot sleep. this house is IT for us.

day 12, 9:38am:

OFFER ACCEPTED!!!!!!

so yes. that has been the last 12 days of my life. we will probably still not manage it within the two months but we have friends we can stay with while waiting for the sale to complete.

HOLY SHIT WE ARE BUYING A HOUSE!!!!!

Holy shit baby, this took us on a JOURNEY. What a wild ride!

This is exciting news and we're absolutely thrilled for you. Fuck your uncaring landlord and hell yeah to those sellers who saw your inherent brilliance!

53 notes

·

View notes

Text

Despite having our offer accepted, the solicitors appointed, and the mortgage agreed, the part that makes it the most real is having it taken down from the agent's site and Rightmove. AHHHHHHH

8 notes

·

View notes

Text

It's so funny, having to prove how mentally and physically healthy, and how financially stable and well-off you are in order to get a mortgage, when you're living under the most stressful period of limbo and paying for solicitors left, right and centre. 'Has your depression improved/remained the same/increased over the last year?' 'What's the balance on your credit cards?' Let me tell you that the answers to these questions are VERY contextual, ok?

5 notes

·

View notes

Text

oh i uh. i didn't tell you guys.

i'm in the process of buying an apartment. i hate mortgages and solicitors are all part vulture i swear to god BUT. but. i'm going to be a homeowner.

#in this economy? i don't blame them all running checks on my accounts LOL#not renting no NO NEVER RENTING ME AND MY GIRLS ARE GETTING OUR OWN PLACE#its smack bam in the center of a cute town in somerset. the site was my mum's old gymnasium when she was a child ;_;!#i'm aiming to be moved in properly by summer. the legal bits take a while apparently.#tbd

3 notes

·

View notes

Text

pros of House Buying Mode: endless energy for phone calls, turbo supercharge boost to organisational skills, instant hypercompetence in multiple types of social situations, extensive knowledge of required paperwork and processes

cons of House Buying Mode: cannot fucking sleep. can't go to sleep can't go BACK to sleep once awake even if i wake for the first time at 7:30am on a saturday, SUNDAYS ARE UNBEARABLE BECAUSE ALL THE ESTATE AGENTS AND SOLICITORS AND MORTGAGE PEOPLE ARE CLOSED AND MY BRAIN WON'T LET ME DO ANYTHING THAT ISN'T ABOUT HOUSES

#i am. havjng a great time why do you ask#we have two months and counting down until the landlord kicks us out#:))))))))#fx.p

8 notes

·

View notes

Text

#intellectual lawyer in Perth#mortgage solicitors in WA#property dispute resolution solicitors#caveat lawyers in WA#property management laws#leasing and property management#property conveyancing solicitors#best debt recovery lawyer#building contract lawyers Perth

0 notes

Text

Simplify Your Financial Future with Remortgage Brokers in Leeds

As a homeowner, you can optimise your financial future using remortgage brokers in Leeds. Whether you're seeking better interest rates, releasing equity, or consolidating debt, a remortgage can be a game-changer. But navigating the complex world of remortgages alone can be daunting. That's where remortgage brokers come in. In this guide, we'll explore the invaluable services offered by these experts and how they can help you secure the best deal for your unique situation.

1. Local Expertise

Leeds is a dynamic and diverse city, and the property market can be equally diverse. Remortgage brokers based in Leeds possess invaluable local knowledge. They understand the intricacies of the Leeds property market, including neighbourhood-specific trends and lenders who are active in the area. This expertise is instrumental in finding tailored solutions for your remortgage needs.

2. Access to Exclusive Deals

Leeds remortgage brokers have established relationships with a network of lenders. This access allows them to present you with exclusive deals and offers that may not be readily available to the public. These tailored options can save you money and time.

3. Simplified Comparison

One of the most significant advantages of working with a remortgage broker is the ability to compare multiple options effortlessly. Instead of approaching each lender individually, a broker streamlines the process by presenting you with a curated selection of options that align with your goals.

4. Expert Guidance

Remortgage brokers offer expert guidance throughout the remortgage process. They'll assess your financial situation, help you understand your eligibility, and advise you on the most suitable products. This personalised support from remortgage brokers in Leeds ensures that you make informed decisions.

5. Time and Money Savings

Time is money, and a remortgage broker can save you both. They handle the paperwork, negotiate with lenders, and ensure your application is processed efficiently. This minimises stress and maximises your chances of a successful remortgage.

6. Long-Term Financial Planning

Beyond the immediate benefits of securing a remortgage, brokers can help you align your remortgage with your long-term financial goals. Whether it's reducing your mortgage term or accessing equity for investments, they can offer strategic insights.

Conclusion

In conclusion, remortgage brokers are your allies in optimising your homeownership experience. With their local expertise, access to exclusive deals, simplified comparison, expert guidance, and time-saving capabilities, they are your ticket to a brighter financial future in this vibrant city. Don't miss the opportunity to make the most of your home; consult with professional remortgage brokers in Leeds today.

1 note

·

View note

Text

What is Acceptable Proof of Ownership?

Sometimes Jamaica Homes, will ask for proof of ownership for a property to ensure that you are the rightful owner or have the owner’s permission to list the rental property. The following documents are accepted as proof of ownership: Land Registry Title Insurance Certificate Signed Letter from Solicitor (Completion Letter or Confirming Ownership) Mortgage Letter You can email any of these…

0 notes

Text

What Services Do Mundoolun Real Estate Agents Provide for First-Time Buyers?

Purchasing a home is an exciting milestone, especially for first-time buyers. However, the process can also feel overwhelming, with numerous factors to consider. To ensure that your journey is as smooth as possible, partnering with a skilled real estate agent can make a significant difference. In Mundoolun, real estate agents specialize in guiding first-time buyers through each step, from initial search to final purchase.

What Makes Mundoolun Real Estate Agents Stand Out for First-Time Buyers?

Real estate agents in Mundoolun are highly experienced in the local property market, giving them a competitive edge when helping first-time buyers. Their in-depth knowledge of the region and its neighborhoods allows them to offer expert advice tailored to your needs. Whether you are searching for a family home, a peaceful retreat, or a property with investment potential, Mundoolun real estate agents are equipped to guide you.

Tailored Property Search

One of the most crucial services that real estate agents in Mundoolun provide is assisting first-time buyers in finding the right property. Agents take the time to understand their clients' preferences, including budget, desired location, and type of property. By knowing exactly what you’re looking for, agents can narrow down the options, ensuring that you only view homes that match your criteria.

Furthermore, real estate agents have access to a wide range of listings, many of which may not be publicly available. This access to off-market properties increases your chances of finding the perfect home in Mundoolun. Whether you're after a modern property or a charming house with land, real estate agents can help you explore the full spectrum of available options.

Expert Negotiation Skills

When you’re purchasing your first home, it’s essential to have a skilled negotiator on your side. Mundoolun real estate agents possess exceptional negotiation skills that can secure you the best possible price. From making an initial offer to negotiating contract terms, their experience ensures you get the most favorable deal. They are well-versed in local market conditions and can provide invaluable insights on property pricing trends in Mundoolun.

Agents also handle the delicate process of bidding, ensuring that you don’t overpay for a property. By leveraging their negotiation experience, they can potentially save you thousands of dollars, making the whole process more cost-effective.

Guidance Through Legal and Financial Processes

First-time buyers may feel uncertain about the legal and financial aspects of purchasing a property. Real estate agents in Mundoolun offer valuable guidance on these matters, helping you navigate through contracts, terms, and conditions. They can recommend trusted professionals, such as mortgage brokers, solicitors, and conveyancers, ensuring that all aspects of the purchase are handled correctly.

Real estate agents also help first-time buyers understand the financial obligations involved, from deposits and mortgage payments to ongoing maintenance costs. By providing clear explanations, agents make sure you are well-prepared for the financial responsibilities of homeownership.

Assistance with Inspections and Appraisals

When buying a property, it is crucial to understand its condition and value. Mundoolun real estate agents typically assist first-time buyers by recommending qualified inspectors and appraisers. These professionals examine the property for structural integrity, potential issues, and any necessary repairs. With a thorough inspection, buyers can make more informed decisions and avoid unexpected expenses down the line.

In addition, agents often arrange for property appraisals to assess whether the asking price is fair based on market conditions. By organizing these services, real estate agents help first-time buyers avoid costly mistakes and secure a property that meets both their needs and budget.

Support Throughout the Entire Buying Process

The home-buying process is rarely straightforward. Real estate agents in Mundoolun are there to guide you every step of the way. From your initial inquiry to the final signing of the contract, agents provide continuous support and advice. They help first-time buyers understand complex paperwork and ensure that all deadlines are met.

Additionally, agents act as intermediaries between the buyer and seller, handling communication to ensure that any issues are resolved promptly. This reduces the stress of dealing with the logistics of a property transaction and ensures a smoother, more efficient buying process.

Post-Purchase Assistance

Even after the property purchase is complete, Mundoolun real estate agents continue to offer valuable assistance. They may help you with settling into your new home by recommending local service providers, from home maintenance experts to utility companies. Agents are often a source of ongoing support, answering questions that may arise after the transaction is complete.

This post-purchase support ensures that first-time buyers feel confident and settled in their new home. Whether you need advice on property management or tips on local amenities, real estate agents remain a helpful resource.

Why Choose Mundoolun Real Estate Agents for First-Time Homebuyers?

The decision to purchase a home is one of the most significant financial investments in a person’s life. For first-time buyers, the process can be filled with uncertainty and confusion. However, real estate agents in Mundoolun provide expert advice, comprehensive services, and personalized support, making the entire journey easier and less stressful.

From finding the perfect property to negotiating the best price, real estate agents in Mundoolun ensure that first-time buyers are well-informed and well-supported. Their local expertise and commitment to customer service create an optimal environment for successful property purchases.

In conclusion, for first-time homebuyers in Mundoolun, working with experienced and professional real estate agents can help turn a potentially daunting process into a positive and rewarding experience. By offering tailored property searches, expert negotiation, legal guidance, and post-purchase support, real estate agents in Mundoolun play an essential role in helping first-time buyers find their dream homes with confidence.

0 notes